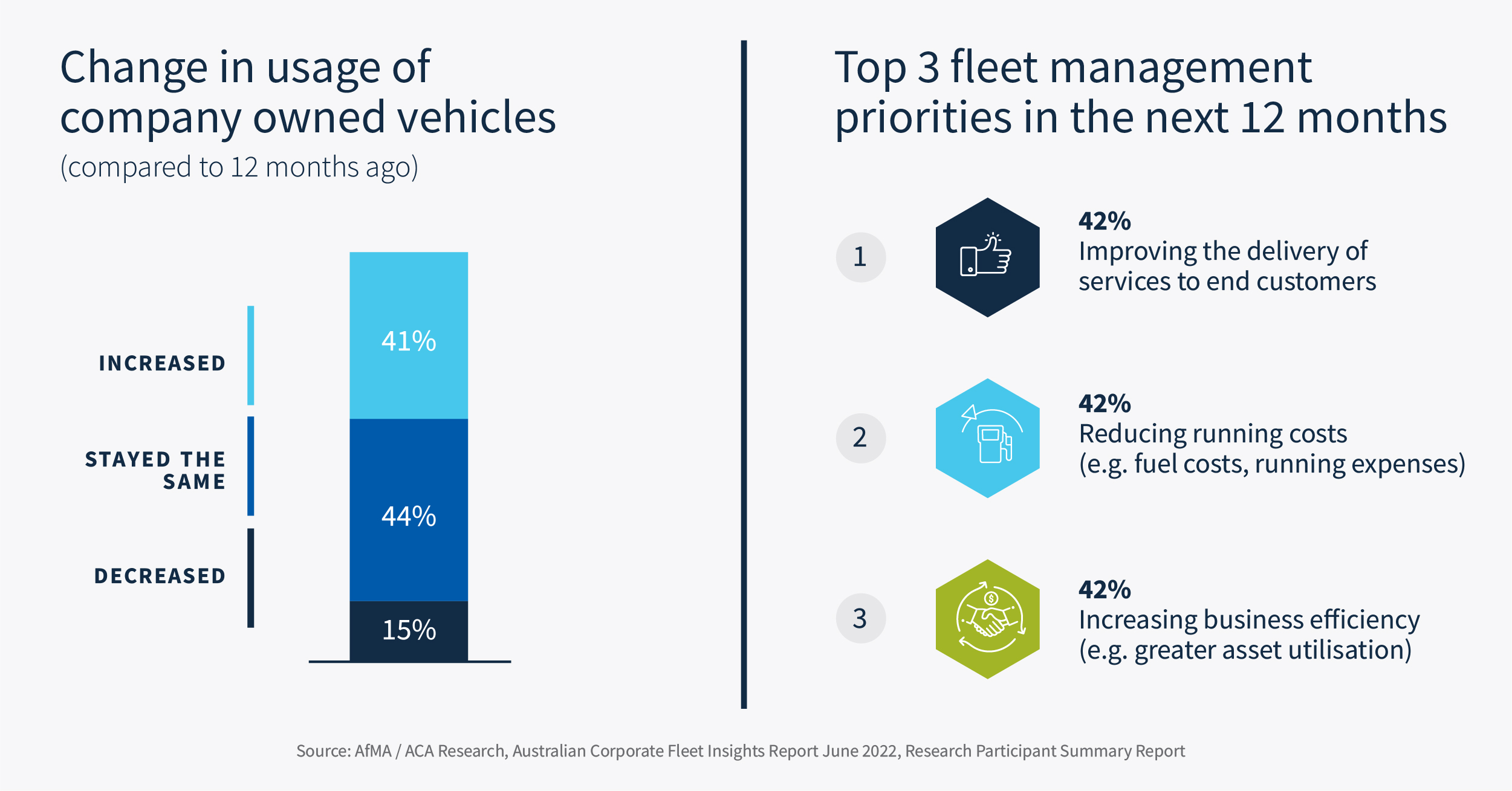

As fleets across Australia see the increasing use of company vehicles, 41% over the last 12 months1, they’ve agreed focus will now need to turn to how they can continue to reduce costs and improve business efficiency – all while keeping the service delivery to end clients on an upwards trajectory2.

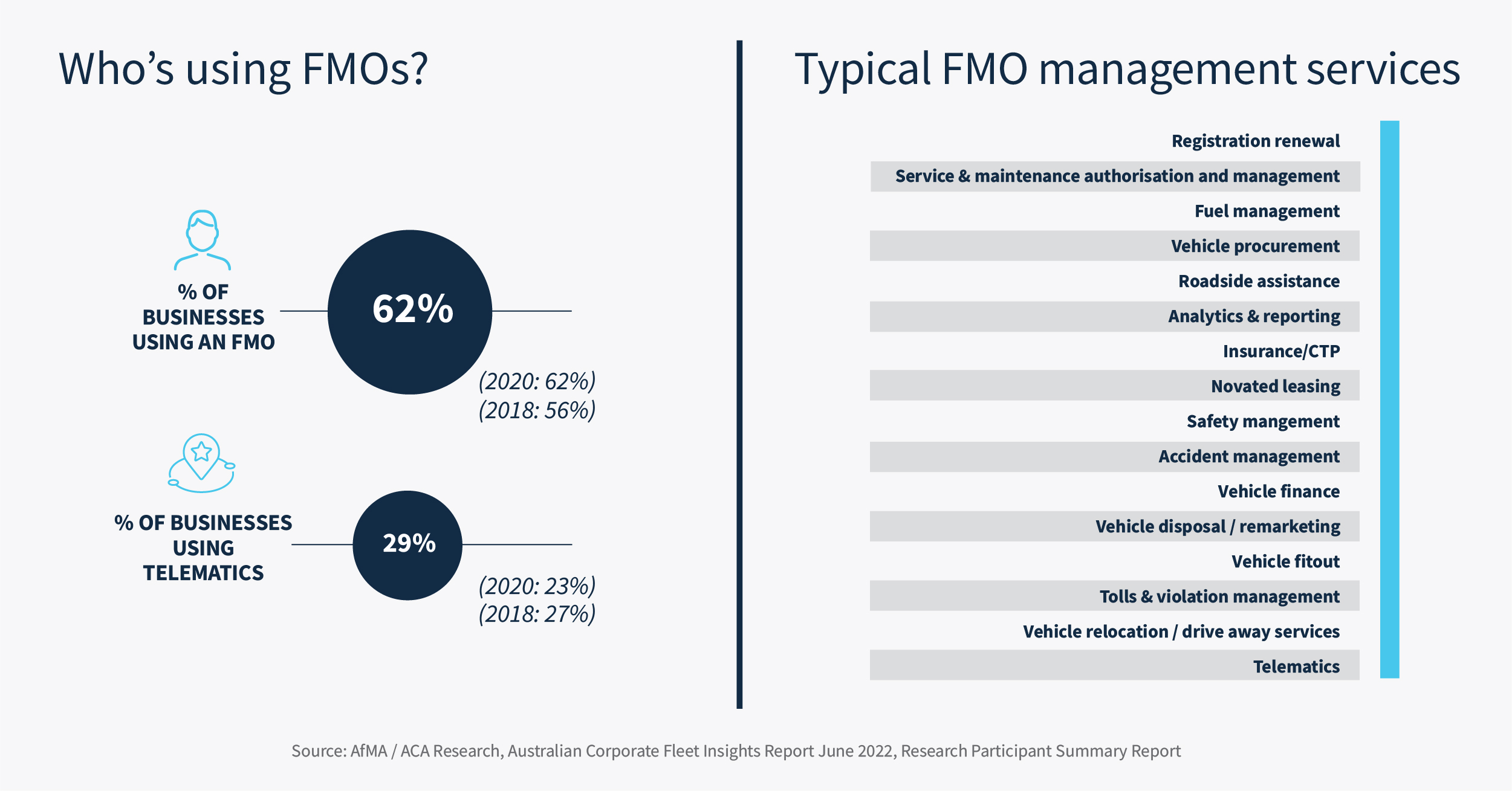

We have already seen fleet managers move quickly to solve the challenges of business improvement with the help of their FMO. But, according to AfMA’s Fleet Insights Report 2022, there still remains little movement in the cohort who are choosing not to lean on an FMO, or externally, for support.

Should organisations be reconsidering this decision? We explore the role of the FMO and how Australian fleets are extracting value.

Case study: Benefits of outsourcing to a FMO

Watch Hempel share the reasons why they choose to partner with Interleasing and why this relationship works for them.

Embedding FMOs across a vehicle’s lifecycle is a trend we are seeing at a strategic level

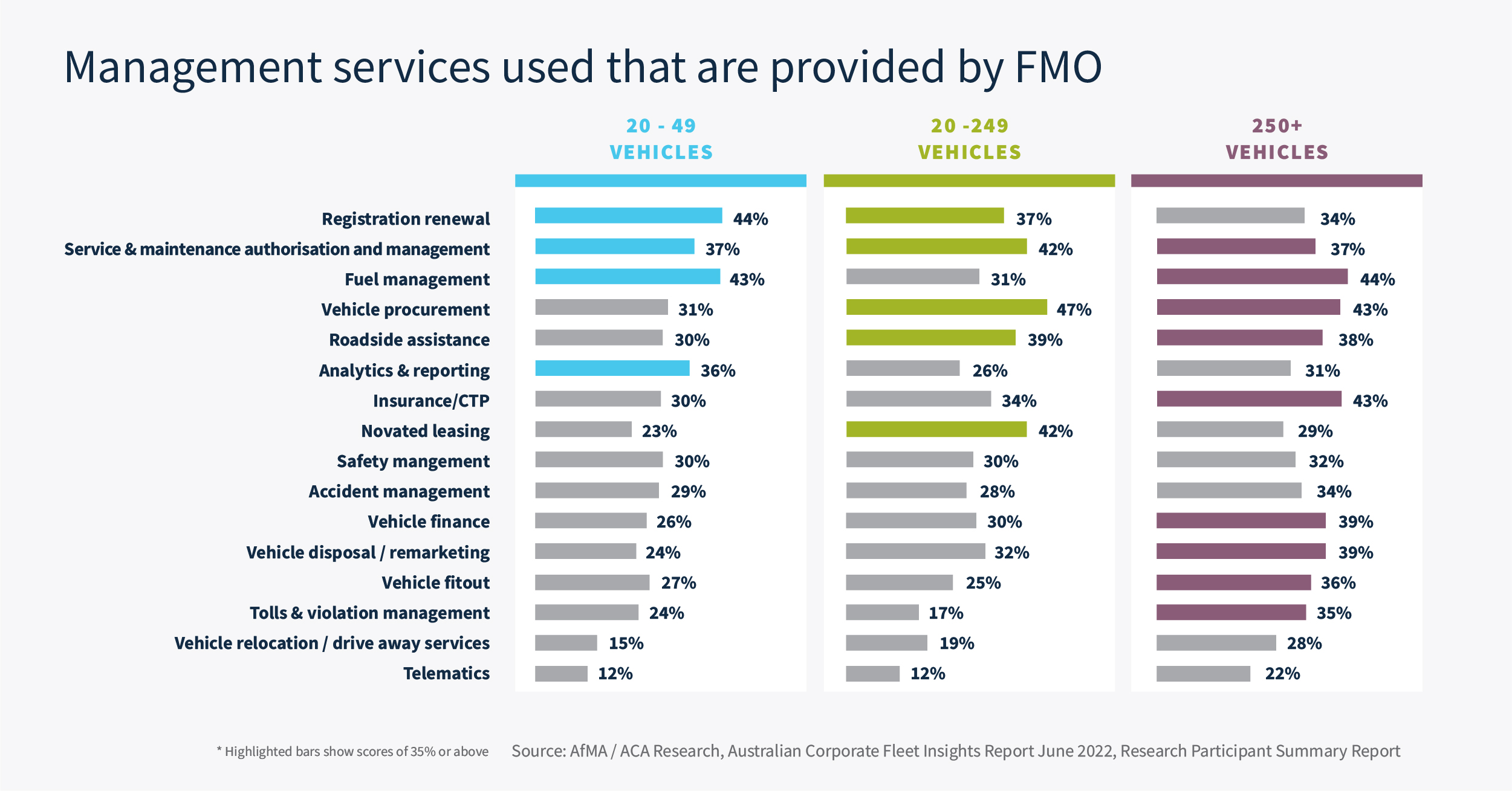

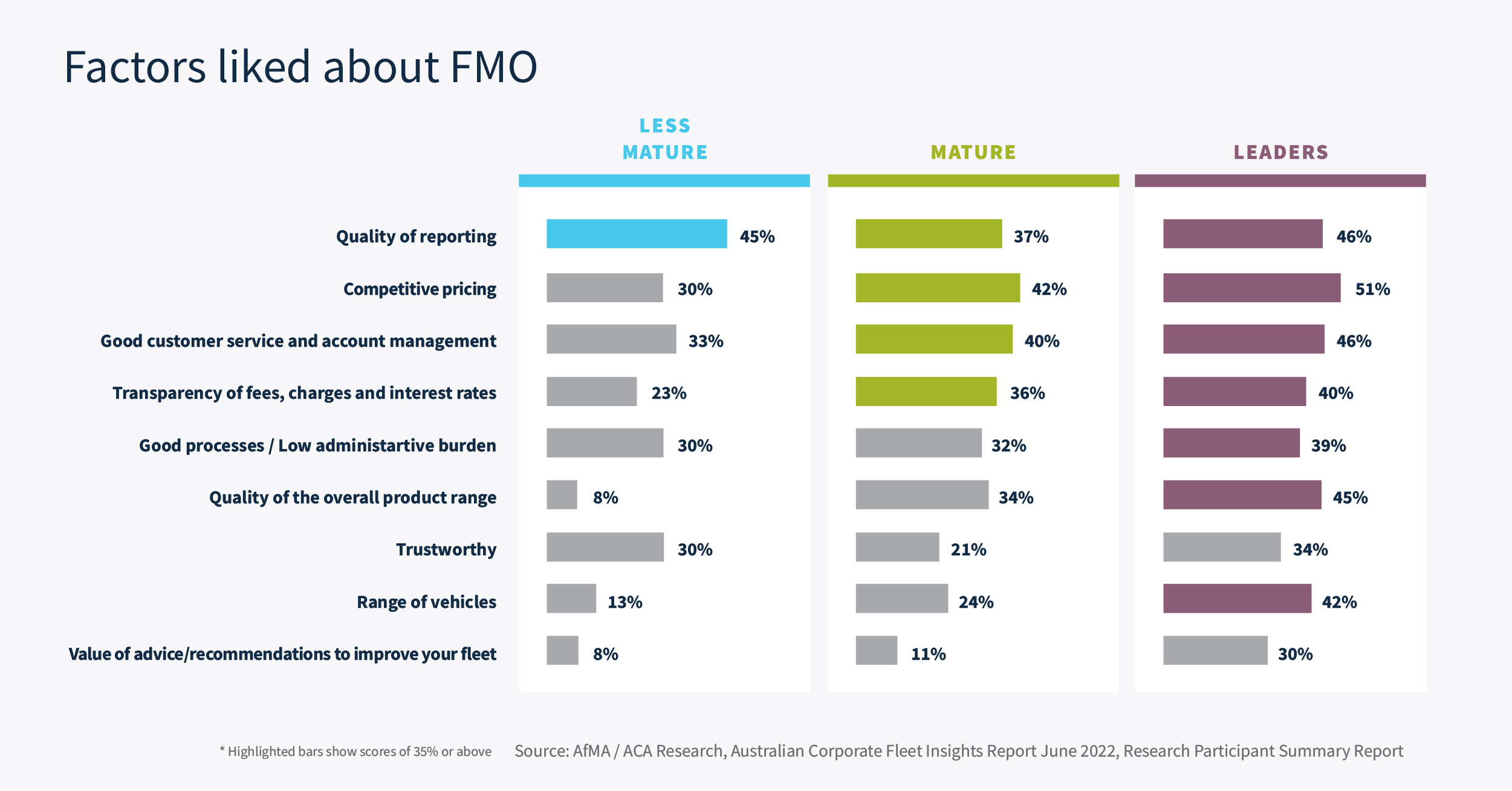

AfMA’s latest fleet research shows us that as fleets grow so does their willingness to lean on FMOs to meet more complex needs and to utilise them across all phases of the lifecycle – acquisition, ongoing management, and disposal. This is particularly true for those fleets that give more priority to strategic aspects of fleet management that impact business performance, customer experience and the environment – these fleets are considered to be either ‘leaders’ or ‘mature’ in AfMA’s recent research.

Transparency of pricing, reporting, customer service and the strategic advice FMOs can offer organisations when making key decisions are what ‘leaders’ and ‘mature’ fleets value the most.

The importance of a FMO relationship to Australian Red Cross

Watch how the Red Cross view their partnership with Interleasing and what the depth of that relationship means for their organisation.

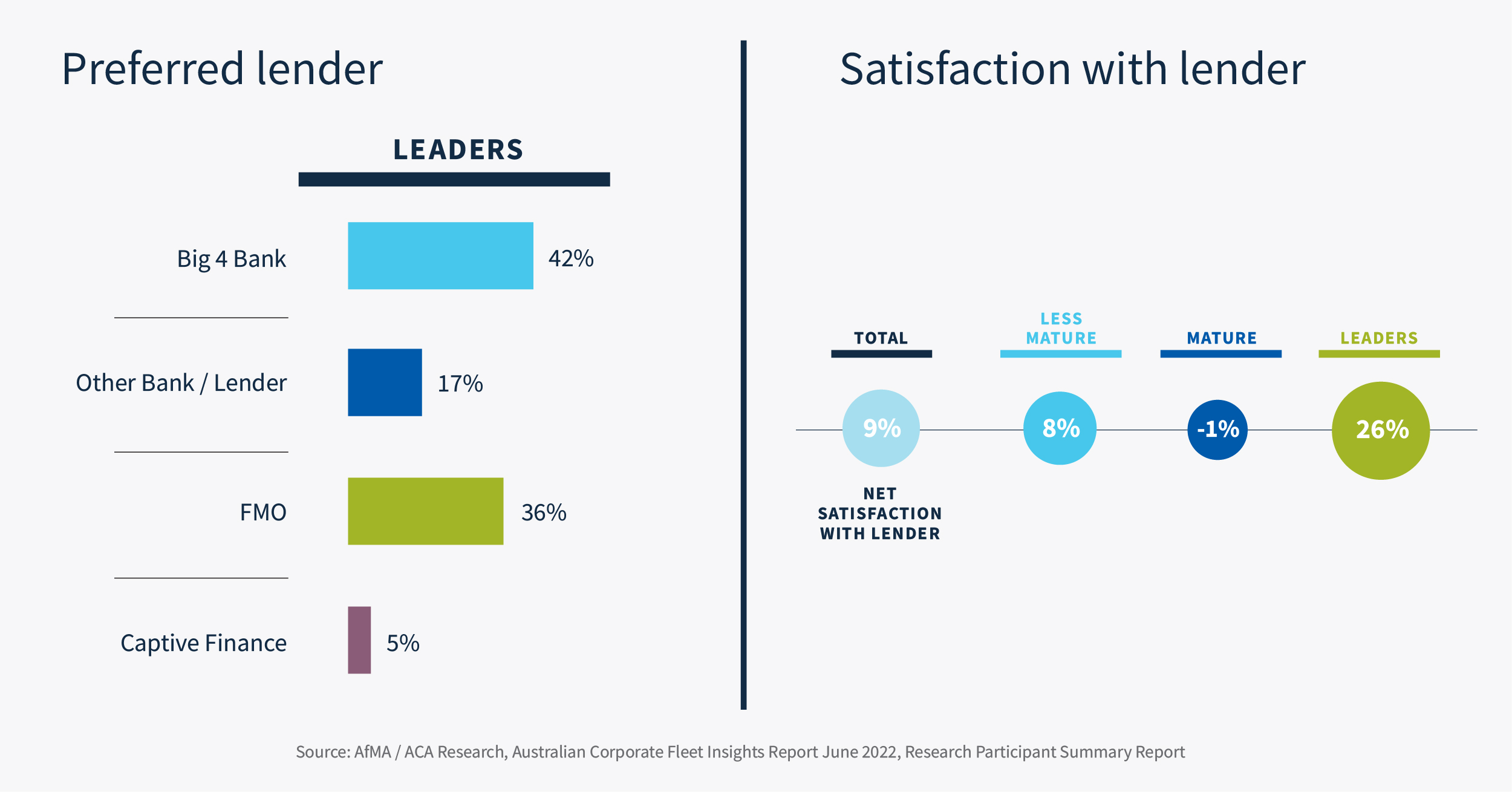

Fleet leaders are also using FMO relationships to fulfil financing needs

When it comes to organising the financing for their fleet, leaders are not only more likely to use FMOs for vehicle financing, but they are more satisfied with their lender arrangement than any other market segment.

In a year when cost reduction will be further in the limelight throughout fleets, using financing avenues outside dealers and the big banks could prove a worthwhile strategy to adopt.

According to Interleasing’s Anthony Perri, General Manager – Customer Relations & Sales, FMOs can provide asset managers and their businesses with “cash flow predictability, reduction of residual value risk, a reduction in maintenance risk (as someone else is doing this function for you) and many supply chain benefits such as discounts on fuel. Leaving it to your FMO experts can not only make financial sense, but can also alleviate a high level of administration capacity and pressure.”

We go the extra mile to deliver value

Providing our clients with a whole of life cost analysis and flexible leasing options are just some of the ways we work with fleet managers to optimise ROI and identify and manage risks for their fleet assets and operations. In our Managing Fleet Risk Guide we share a holistic view of the different types of risk associated with running a fleet and share ideas and best-practice tips for developing a robust and comprehensive fleet policy.

For more about how we can help your fleet perform at its best, get in touch today.